Chipotle’s Business Model and Performance: Chipotle Stock

Chipotle Mexican Grill, a fast-casual restaurant chain specializing in customizable burritos, bowls, salads, and tacos, has become a popular choice for health-conscious consumers. Its success is attributed to its unique business model, which emphasizes fresh, high-quality ingredients, a focus on customization, and a commitment to sustainability. However, the company has also faced challenges in recent years, including food safety concerns and increased competition.

Chipotle’s Business Model

Chipotle’s business model revolves around providing a fast-casual dining experience with a focus on fresh, high-quality ingredients. The company emphasizes customization, allowing customers to choose their own ingredients and create their ideal meal. This approach has been successful in attracting a loyal customer base that appreciates the flexibility and control over their food choices.

Strengths

- Fresh, high-quality ingredients: Chipotle uses fresh, high-quality ingredients, including organic and locally sourced options whenever possible. This commitment to quality has resonated with consumers who are increasingly concerned about the origin and quality of their food.

- Customization: Chipotle’s menu allows customers to customize their meals, catering to a wide range of dietary preferences and allergies. This flexibility is a key driver of customer satisfaction and loyalty.

- Sustainability: Chipotle is committed to sustainable practices, sourcing ingredients responsibly and minimizing its environmental impact. This commitment appeals to environmentally conscious consumers.

- Strong brand recognition: Chipotle has established a strong brand identity, known for its fresh ingredients, customizable meals, and commitment to sustainability. This brand recognition translates into high customer loyalty and a strong competitive advantage.

Weaknesses

- Food safety concerns: Chipotle has faced several food safety outbreaks in recent years, which have negatively impacted its reputation and sales. The company has implemented new safety protocols and procedures to address these concerns, but the perception of food safety remains a challenge.

- High labor costs: Chipotle’s commitment to fresh ingredients and customization requires a significant labor force, leading to higher labor costs compared to competitors. This can impact profitability, especially in a competitive market.

- Limited menu: Chipotle’s menu is relatively limited compared to other fast-casual restaurants. This can limit its appeal to customers seeking a wider variety of options.

- Price sensitivity: Chipotle’s pricing is generally higher than competitors, which can make it less attractive to price-sensitive consumers.

Chipotle’s Financial Performance

Chipotle’s financial performance has been strong in recent years, with revenue growth and profitability exceeding industry averages. The company has also managed its debt levels effectively, maintaining a healthy balance sheet.

Revenue Growth

- Chipotle’s revenue has grown steadily in recent years, driven by new restaurant openings and increased same-store sales. In 2022, the company’s revenue reached $8.5 billion, representing a significant increase from previous years.

Profitability

- Chipotle’s profitability has also been strong, with operating margins exceeding 20% in recent years. This reflects the company’s ability to control costs and generate significant profits from its operations.

Debt Levels

- Chipotle’s debt levels are relatively low, with a debt-to-equity ratio of less than 0.5. This indicates that the company has a strong financial position and is not overly reliant on debt financing.

Chipotle’s Performance Compared to Competitors

Chipotle’s performance has consistently outpaced its competitors in the fast-casual restaurant industry. The company’s focus on fresh, high-quality ingredients, customization, and sustainability has resonated with consumers, driving strong revenue growth and profitability.

Key Competitors

- Qdoba: Qdoba is a major competitor to Chipotle, offering a similar menu of customizable burritos, bowls, and salads. However, Qdoba has a more extensive menu and a broader geographic reach.

- Moe’s Southwest Grill: Moe’s Southwest Grill is another significant competitor, offering a similar menu and dining experience to Chipotle. However, Moe’s has a more casual atmosphere and a lower price point.

- Panera Bread: Panera Bread is a fast-casual restaurant chain that offers a wider variety of menu items, including soups, salads, sandwiches, and baked goods. However, Panera’s focus on fresh, high-quality ingredients and customizable options aligns with Chipotle’s core values.

Comparison of Key Metrics

| Metric | Chipotle | Qdoba | Moe’s Southwest Grill | Panera Bread |

|---|---|---|---|---|

| Revenue (2022) | $8.5 billion | $1.5 billion | $1 billion | $4.5 billion |

| Operating Margin (2022) | 22% | 15% | 10% | 18% |

| Debt-to-Equity Ratio (2022) | 0.4 | 0.6 | 0.8 | 0.3 |

Chipotle’s Growth Strategy

Chipotle’s growth strategy is multifaceted, encompassing menu innovation, expansion plans, and digital initiatives. These strategies aim to increase customer base, boost revenue, and enhance brand loyalty.

Menu Innovation

Menu innovation is a crucial element of Chipotle’s growth strategy. The company regularly introduces new menu items and limited-time offerings to cater to evolving customer preferences and attract new customers.

- Seasonal Menu Items: Chipotle introduces seasonal menu items, like the Chorizo, to provide variety and generate excitement among customers. These limited-time offerings often become popular and encourage repeat visits.

- Vegan and Vegetarian Options: Chipotle has expanded its menu to include more vegan and vegetarian options, responding to the growing demand for plant-based food. This move attracts a broader customer base, including those with dietary restrictions.

- Focus on Freshness and Quality: Chipotle’s commitment to using fresh, high-quality ingredients is a core part of its brand identity. The company regularly sources new ingredients and explores innovative ways to enhance the flavor and quality of its food.

Expansion Plans

Chipotle’s expansion plans are another key driver of growth. The company continues to open new restaurants in both existing and new markets.

- Domestic Expansion: Chipotle has been expanding its presence in the United States, particularly in suburban areas and smaller cities. This strategy allows the company to tap into new customer bases and capture market share.

- International Expansion: Chipotle has also been expanding internationally, with restaurants in Canada, the UK, and France. The company is targeting markets with high demand for fast-casual dining and a growing appreciation for Chipotle’s unique menu.

- Restaurant Formats: Chipotle is experimenting with new restaurant formats, such as smaller-format restaurants and digital kitchens. These formats offer flexibility and allow the company to adapt to changing consumer preferences.

Digital Initiatives

Chipotle has invested heavily in digital initiatives to enhance the customer experience and drive growth.

- Mobile Ordering and Payment: Chipotle’s mobile ordering and payment system allows customers to place orders and pay for their meals from their smartphones, providing convenience and efficiency.

- Loyalty Program: Chipotle’s loyalty program rewards customers for repeat business, encouraging frequent visits and driving sales. The program also provides valuable data on customer preferences, which can be used to inform menu development and marketing strategies.

- Digital Marketing: Chipotle uses targeted digital marketing campaigns to reach potential customers and promote new menu items and special offers. This approach allows the company to connect with customers in a personalized and engaging way.

Factors Influencing Chipotle’s Stock Price

Chipotle Mexican Grill, a leading fast-casual restaurant chain, has experienced significant stock price fluctuations in recent years. Understanding the factors that influence Chipotle’s stock price is crucial for investors seeking to make informed decisions.

Economic Conditions

Economic conditions play a significant role in shaping consumer spending habits, which directly impact Chipotle’s revenue and profitability. A strong economy typically leads to increased consumer confidence and discretionary spending, boosting demand for Chipotle’s products. Conversely, economic downturns can result in reduced consumer spending, impacting Chipotle’s sales and stock price.

Consumer Trends

Chipotle’s stock price is highly sensitive to changes in consumer preferences and trends. The company’s success hinges on its ability to cater to evolving consumer demands for healthier, fresh, and ethically sourced food options. Factors such as rising health consciousness, growing interest in sustainable food practices, and changing dietary preferences can significantly influence Chipotle’s performance and stock valuation.

Industry Competition

The fast-casual restaurant industry is highly competitive, with numerous players vying for market share. Chipotle faces competition from established chains like Panera Bread and Subway, as well as emerging brands offering similar menu options. Competitive pressures can impact Chipotle’s pricing strategies, market share, and profitability, ultimately affecting its stock price.

Financial Performance

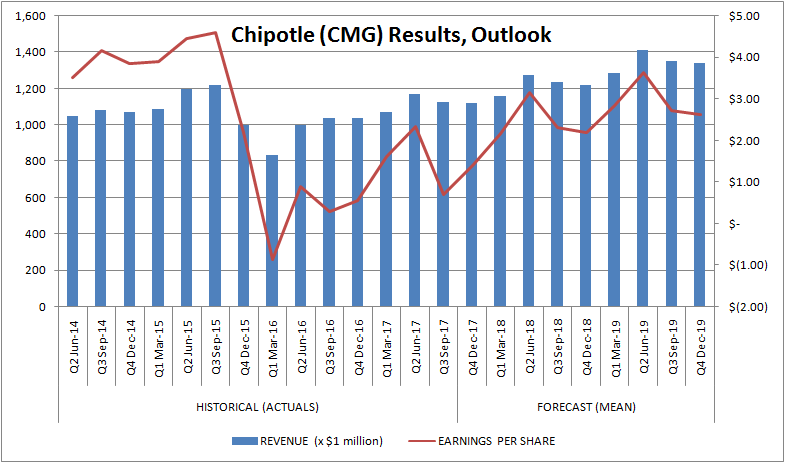

Chipotle’s stock price is directly linked to its financial performance, including revenue growth, profitability, and earnings per share (EPS). Strong financial results, such as increased sales and improved margins, tend to boost investor confidence and drive up the stock price. Conversely, disappointing financial performance can lead to a decline in stock value.

Operational Efficiency

Chipotle’s stock price is also influenced by its operational efficiency. Factors such as labor costs, food costs, and supply chain management can impact the company’s profitability and overall performance. Effective operational strategies that minimize costs and maximize efficiency can contribute to a positive stock price outlook.

Regulatory Environment, Chipotle stock

The restaurant industry is subject to various regulations related to food safety, labor practices, and environmental sustainability. Changes in regulations can impact Chipotle’s operating costs, compliance requirements, and overall business environment, influencing its stock price.

Public Perception and Brand Image

Chipotle’s stock price can be affected by public perception and brand image. Positive media coverage, customer satisfaction, and strong brand loyalty can enhance investor confidence and drive up the stock price. Conversely, negative publicity or reputational damage can lead to a decline in stock value.

Table of Factors and Impact

| Factor | Positive Impact | Negative Impact |

|---|---|---|

| Economic Conditions | Strong economic growth leads to increased consumer spending and demand for Chipotle’s products, boosting revenue and stock price. | Economic downturns can result in reduced consumer spending, impacting Chipotle’s sales and stock price. |

| Consumer Trends | Growing demand for healthy, fresh, and ethically sourced food options aligns with Chipotle’s offerings, driving sales and stock price. | Changes in consumer preferences or emergence of new food trends that do not align with Chipotle’s offerings can negatively impact sales and stock price. |

| Industry Competition | Chipotle’s strong brand recognition, loyal customer base, and focus on quality can help it maintain market share and compete effectively, supporting stock price. | Increased competition from new entrants or established players can lead to price wars, reduced market share, and lower profitability, impacting stock price. |

| Financial Performance | Strong revenue growth, profitability, and earnings per share (EPS) boost investor confidence and drive up stock price. | Disappointing financial performance, such as declining sales or reduced margins, can lead to a decline in stock value. |

| Operational Efficiency | Effective cost management, efficient supply chain, and optimized labor practices enhance profitability and contribute to a positive stock price outlook. | Inefficiencies in operations, such as high labor costs or supply chain disruptions, can negatively impact profitability and stock price. |

| Regulatory Environment | Favorable regulations that support the restaurant industry can create a positive business environment, boosting stock price. | Unfavorable regulations, such as stricter food safety standards or labor laws, can increase operating costs and negatively impact profitability and stock price. |

| Public Perception and Brand Image | Positive media coverage, strong brand loyalty, and customer satisfaction enhance investor confidence and drive up stock price. | Negative publicity, reputational damage, or customer dissatisfaction can lead to a decline in stock value. |

Impact on Future Earnings and Valuation

The factors discussed above can significantly impact Chipotle’s future earnings and valuation. For example, strong economic growth and favorable consumer trends can lead to increased sales and profitability, driving up earnings and potentially boosting the stock price. Conversely, increased competition, regulatory challenges, or negative public perception can negatively impact earnings and valuation.

Chipotle’s stock price is a reflection of its future earnings potential, which is influenced by a complex interplay of factors, including economic conditions, consumer trends, industry competition, and its own operational performance.